Portfolio Policy

Investment Strategy

The Investment Corporation will build an initial portfolio by using the below allocation policy, by emphasizing the age and size of properties and by carefully looking at the areas where properties are located as well as the quality and credit of tenants.

The allocation by location

The Investment Corporation sets the following target allocation for the allocation of investment by location expressed as a percentage of the entire portfolio of the Investment Corporation (acquisition price basis) from the perspective of stability and enhancement of unitholder value.

- May temporarily deviate from the above ratio due to the acquisition in the implementation of growth strategy.

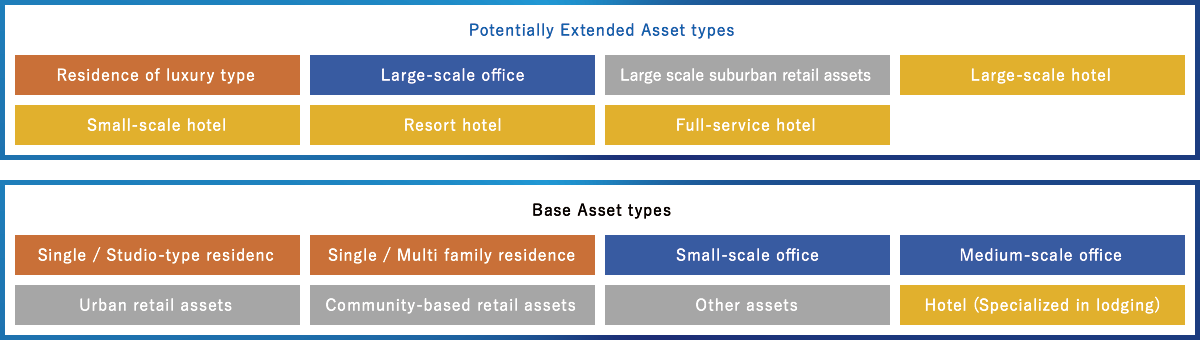

The allocation by asset type

We intend to invest mainly in office and residential properties. We also intend to invest in hotel, retail and other properties. We expect that 70% or more of our portfolio will be allocated to office and residential properties, while 30% or less will be allocated to hotel, retail and other properties, on an acquisition price basis.

Investment Strategy to Achieve Strong Growth

The Investment Corporation aims to shift to a more proactive management strategy for maximization of unitholder returns, depending on expansion of asset size (total acquisition price of assets in the portfolio).

- The above asset size is the Investment Corporation’s target and policy as of the date of this material, which may be reviewed from time to time for various reasons. For example, we may revise our growth strategy before achieving these targets or may keep our strategy the same even after achieving these targets, as long as market conditions or other factors warrant such change in strategy.

Portfolio Policy by Asset Type

The Investment Corporation aims to build a diverse and stable portfolio, made up of residential, office, hotel, and retail and other properties by leveraging sponsors’ development capabilities and sourcing capabilities. In addition, property election is as follows;

Residence

The Investment Corporation invests in residential properties of each of the single, studio and family types, which are expected to have relatively stable leasing demand and rent level resilient to economic fluctuation.

■Single / Studio / Family type

| Type | The main tenant area and the exclusive area for each door |

|---|---|

| Single | For single-person households; between 20㎡ and 40㎡ |

| Studio | For two-or-more-person households; 40㎡ or more |

| Family | For three-or-more-person households; 50㎡ or more |

- In principle, limited to the residences within approx. 10-minute walk from the nearest station or the nearest major bus stop

- Luxury type residences are excluded from the target of base assets

Office

The Investment Corporation invests, in principle, in small- and medium-scale properties, which are expected to have relatively stable leasing demand in light of the price range having the largest market in terms of number of properties and number of tenants and also new supply of properties with sufficient facilities and specifications being limited.

■Small- and medium-scale office buildings

- Small-scale office building (total floor area of less than 2,000㎡) and medium-scale office building (total floor area between 2,000㎡ and 20,000㎡)

- Limited to the office buildings located within approx. 10-minute walk from the nearest station

Retail and other assets

The Investment Corporation invests mainly in community-based retail assets, which are expected to have steady demand from tenants meeting stable needs closely linked to the community’s daily living, and urban retail assets, which have the potential to tap the increase in inbound tourism demand.

■Community-based / Urban retail properties

- Limited to the properties easily accessible by ordinary means of transportation (train, bus, car, etc.)

| Community-based retail properties | Investment target | |

|---|---|---|

| Community shopping centers (CSC) (Area: more than 5km and 10km or less radius; Store floor size : around 10,000 to 30,000㎡) |

||

| Neighborhood shopping centers (NSC) (Area : 5km or less; Store floor size: around 3,000 to 10,000㎡) |

||

| Urban retail assets | ||

Community-based retail properties

Retail properties whose commercial area is approx. 1 to 10 km radius and consist of tenants used by consumers on a daily basis

Urban retail properties

Retail properties located in areas adjacent to major stations or busy areas that have good visibility or attract customers

Hotel

The Investment Corporation invests, in principle, in hotels specialized in lodging, which are expected to have stable revenue resilient to economic fluctuation.

■Hotels (Specialized in lodging)

- Hotels focusing on lodging with limited or minimum incidental facilities such as restaurants and banquet halls

- Limited to hotels located in areas easily accessible to major transportation nubs such as air ports, major railway stands and highways adjacent to terminals or busy areas.

- In principle, Limited to medium-scale hotels with 30 or more and less than 300 guest rooms