Financial Strategy

Basic Policy

The basic policy is to establish a stable and sound financial base with the aim of securing stable earnings over the medium to long term and realizing sustained growth of assets under management.

| Equity Finance | We may issue additional investment units for the purpose of property acquisitions, repair of our properties, repayment obligations including repayment of borrowings or other activities. In such event, we ensure our financial soundness and are mindful of the potential for dilution of our investment units in order to achieve stable growth in unitholders’ value. |

|---|---|

| Debt Finance | We may take out borrowings or issue long-term or short-term investment corporation bonds for the purpose of investing in properties, conducting repairs or other work, paying cash distributions, repaying our obligations (including repayment of tenant leasehold or security deposits, and obligations related to borrowings or long-term or short-term investment corporation bonds) and other activities. We effectively control debt maturities by diversifying maturity dates for our borrowings and long-term or short-term investment corporation bonds in order to minimize refinancing and interest rate risk. We diversify our funding sources and maintain multiple financing options including committed lines of credit or borrowings. |

| LTV | We have set an upper limit of 60% as a general rule for the LTV(Note) ratio in order to operate with a stable financial condition. |

- LTV ratio = Total amount of interest-bearing liabilities as of the end of the fiscal period / (Total assets as of the end of the fiscal period – Expected distribution amount) × 100

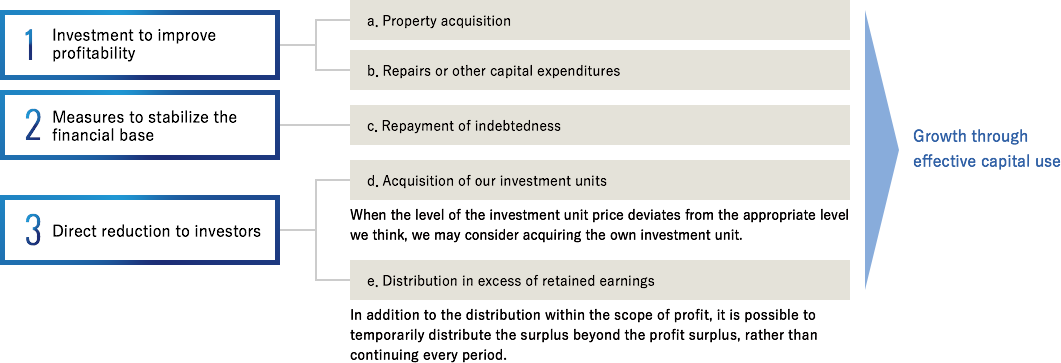

Cash Management Policy

We conduct an efficient and appropriate cash management by monitoring and accurately recognizing our expected financial needs of our portfolio.