External Growth Strategy

Leverage MIRARTH HOLDINGS Group’s development capabilities

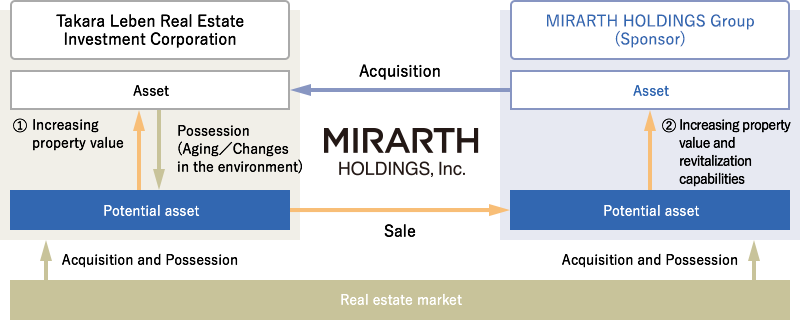

We aim to enhance the competitiveness of our properties where we believe their value can be increased through capital expenditures. Toward this end, we will leverage support from both Takara Leben Group and PAG, but also expect to take advantage of the expertise of the Asset Manager’s experienced management team, composed of experts in development, investment, leasing, management and increasing property value. In addition, if extensive repair is required or it becomes necessary to rebuild a property or convert its asset type due to changes in the environment, we will consider selling the property to MIRARTH HOLDINGS Group, which has recently commenced a property revitalization business, and reacquiring the property after it is improved or revitalized by Takara Leben Group. We believe that this method will not only improve our profitability, but can also revitalize the real estate market and contribute to the economic activity of the surrounding communities. In this way, the property that has room for increasing property value and revitalization capabilities is called "potential asset".

■The cycle image of asset by increasing property value and revitalization capabilities

| Overview of Potential Assets | |

|---|---|

| ① |

|

| ② |

|

- The above chart is image, it does not guarantee that increasing property or acquisition after increasing property value and revitalization capabilities

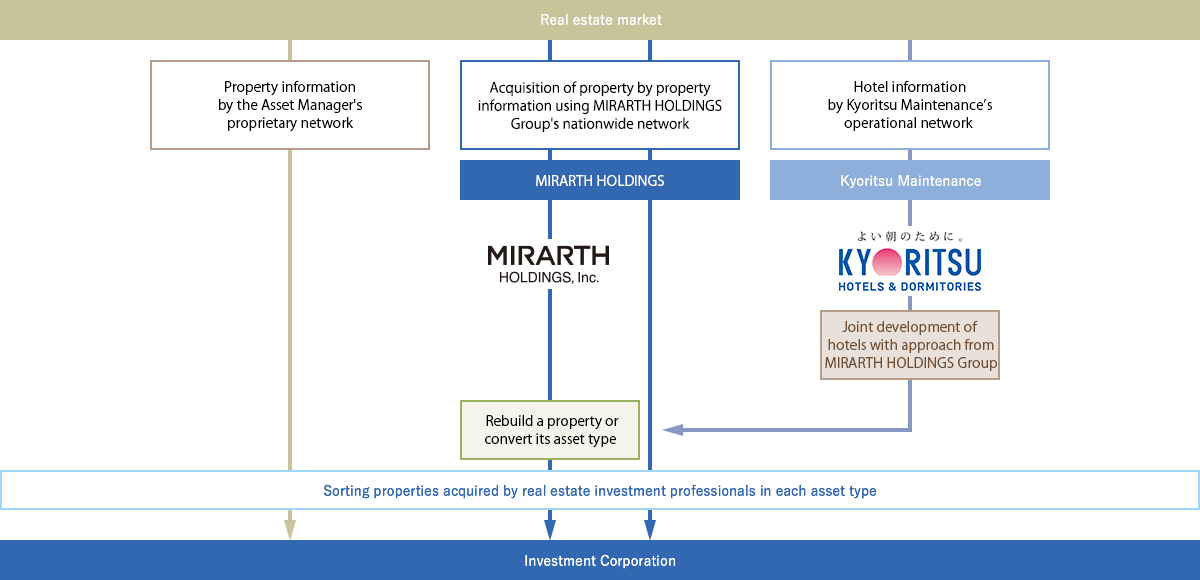

A wide range of property information and acquisition routes utilizing the network of each sponsors

In addition to the Asset Manager's proprietary network, we will use not only the properties owned by sponsors and the properties owned by funds managed by sponsors, but also by expanding the scale of assets, aiming for external growth.

■The main property information and acquisition routes

Abundant pipeline by grant of preferential negotiation rights

TLR have preferential negotiation rights with respect to the acquisition of the properties.

-

| Number of Pipeline | properties | |

|---|---|---|

| Office | ||

| Residence | ||

| Hotel | ||

| Retail and other assets | ||