Sustainability Initiatives

Basic Policy

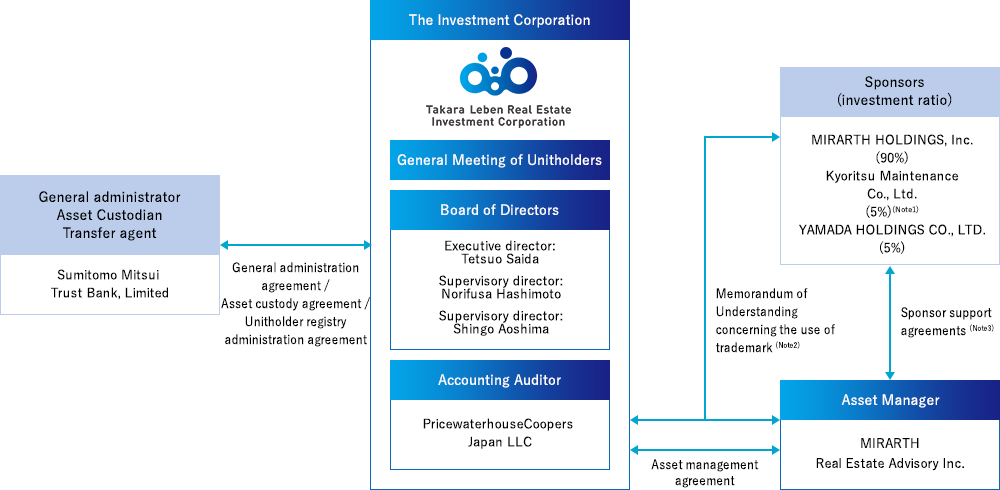

- Takara Leben Real Estate Investment Corporation (TLR) aims to achieve “steady growth” and “stable management” by using a multi-sponsor management structure that combines the expertise and knowledge of sponsor companies with various strengths.

- With the goal of remaining unitholders' diversified J-REIT of choice, TLR aims to achieve “maximization of unitholder value,” “creation of a sustainable environment,” and “contribution to communities and society.”

Structure

Corporate Profile

| Name | Takara Leben Real Estate Investment Corporation |

|---|---|

| Representative | Tetsuo Saida, Executive Director |

| Address | 2-7-17 Hamamatsucho, Minato-ku, Tokyo |

| Asset Management Company | MIRARTH Real Estate Advisory Inc. |

History

| August 28, 2017 | Notification relating to establishment of Takara Leben Real Estate Investment Corporation under Article 69 of the Law Concerning Investment Trusts and Investment Corporations (hereinafter "the Law") by the incorporator, Takara PAG Real Estate Advisory Ltd., currently MIRARTH Real Estate Advisory Inc. |

|---|---|

| September 11, 2017 | Registration of establishment under Article 166 of the Law. Establishment of Takara Leben Real Estate Investment Corporation |

| September 20, 2017 | Application of registration under Article 188 of the Law |

| October 11, 2017 | Registration under Article 187 of the Law by the Prime Minister of Japan (Registration No. 129, filed with the Director of the Kanto Local Finance Bureau) |

| April 5, 2018 | Changing the corporate name from PAG PRIVATE REIT, Inc. to Takara Leben Real Estate Investment Corporation |

Library

TLR publishes an annual ESG Report to promote a deeper understanding of ESG activities.

Reporting Scope/Interval and Timing of Updates

| Reporting scope | TLR and MIRARTH Real Estate Advisory Inc. (TLR's asset management company, hereafter referred to as “the Asset Manager”) In addition to the above two corporations, some activities of MIRARTH HOLDINGS, Inc. which is TLR's main sponsor, are covered. |

|---|---|

| Reporting interval | As a rule, the reporting interval is once per year, but if there are updates to quantitative data or new events occur, the details will be updated as needed and indicated in the update and revision history at the end of the report (excluding minor revisions). |

| Approach to reporting interval and reporting year | As a rule, taking April 1 in a given year as the start date and the end of March in the following year as the end date, the report will cover performance, conditions, etc. for activities conducted during the year in question. However, in some cases, details that fall outside this period will also be included. |

Contact Information for ESG-Related Inquiries

Please use the contact information below for ESG-related inquiries.

| Asset Manager | MIRARTH Real Estate Advisory Inc. |

|---|---|

| Phone no./Opening hours | 03-6435-52649:00 a.m. - 5:30 p.m. (except for Saturdays, Sundays, statutory holidays, and New Year's holidays) |

| info@mirarth-ra.co.jp |