Corporate Governance

TLR was established based on the Act on Investment Trusts and Investment Corporations and is managed by a Board of Directors comprised of one executive director and two supervisory directors. The executive director holds Board of Directors meeting at least once every three months, and in addition to matters for approval as stipulated by law, detailed reports are provided on the execution status of TLR's operations and the Asset Manager's operations. Through this reporting procedure, the supervisory directors, who are independent of the Asset Manager and related interested parties, etc., obtain accurate information, and a structure is maintained that enables them to supervise the executive director's execution of his/her duties. At the same time, based on the reports in question, TLR verifies whether there are any concerns about conflicts of interest in the Asset Manager's transactions with interested parties, etc. and thereby strives to manage risks relating to conflicts of interest, etc.

TLR has the right to receive various types of report from the Asset Manager relating to the asset management outsourcing contract and the right to investigate the Asset Manager's books and other documents. Based on the exercising of the rights in question, TLR maintains a structure that enables it to supervise the Asset Manager's execution of its operations.

Governance Initiatives Policy

In addition to thorough compliance with laws and regulations, we will establish an internal structure and conduct regular employee training for the purpose of promoting sustainability.

TLR's Structure

Refer to the “Structure” section in “Sustainability Initiatives”.

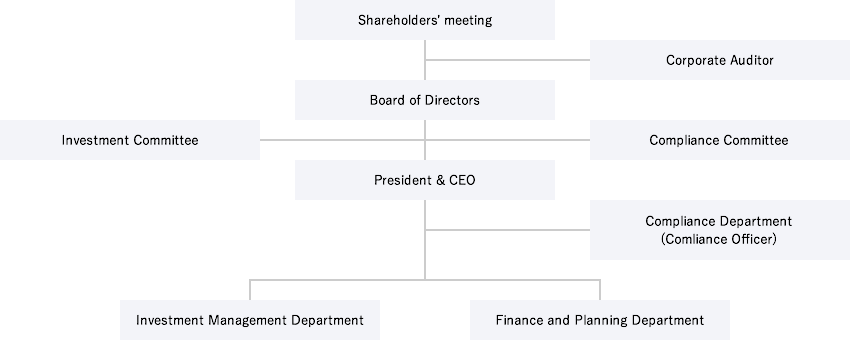

Asset Manager's Structure

Director Selection Criteria/Reasons

When evaluated as candidates, the directors were selected via a resolution of the General Meeting of Unitholders based on the reasons below, conditional upon their circumstances not corresponding to any of the reasons for disqualification stipulated in various laws and regulations, including the Investment Trusts Act (Article 98 and 100 of the Investments Trust Act and Article 244 of the Regulation for Enforcement of the Investment Trusts Act). The current Board of Directors consists of individuals who have no special interest in TLR.

This table can be scrolled sideways.

| Title of Officer | Name | Reasons for Appointment | Board of Directors Meeting Attendance Record |

|---|---|---|---|

| Executive Director | Tetsuo Saida | Possesses extensive real estate- and finance-related business experience and knowledge through his work at business corporations and REIT management companies, and since he possesses appropriate decision-making ability and judgment in the execution of operations, he is considered qualified to serve as the executive director. | 100% (19/19 meetings) |

| Supervisory Directo | Norifusa Hashimoto | Since he possesses professional independence as a lawyer and extensive specialized expertise and auditing experience, he is considered qualified to supervise the administration of TLR from the perspective of a legal expert. | 100% (19/19 meetings) |

| Supervisory Directo | Shingo Aoshima | Since he possesses practical experience and extensive specialized expertise as a CPA and also has auditing experience, he is considered qualified to supervise the execution of the executive director's duties from the perspective of an accounting expert. | 100% (19/19 meetings) |

*Indicates Board of Directors meetings held from January 1, 2024, until December 31, 2024.

Remuneration of Executive Directors and Supervisory Directors

The amount of remuneration shall be determined by the Board of Directors, with a maximum of 800,000 yen/month for the executive director and a maximum of 500,000 yen per month for the supervisory directors.

This table can be scrolled sideways.

| Position | Name of Director | Main Concurrent Positions, etc. | Remuneration Amount by Position | |

|---|---|---|---|---|

| Previous Fiscal Year (7th Fiscal Period) |

Current Fiscal Year (8th Fiscal Period) |

|||

| Executive Director | Tetsuo Saida |

|

- | -,000 yen |

| Supervisory Directors | Norifusa Hashimoto |

|

1.2 million yen | 1.2 million yen |

| Shingo Aoshima |

|

1.2 million yen | 1.2 million yen | |

*Major concurrent positions,etc. as of the end of February 2025

Asset Manager Compensation Structure

Regarding fees paid to the Asset Manager for asset management services, with the aim of further improving the linkage to unitholder profits, TLR presented a revision of the asset management compensation structure at the General Meeting of Unitholders held on November 26, 2021, and since it was approved by the unitholders, the new compensation structure will be applied from March 1, 2022.

This table can be scrolled sideways.

| Management Compensation Structure | Calculation Method | Upper Limit |

|---|---|---|

| Management fee I | Total assets at end of previous fiscal period x 0.3% annual rate (maximum rate) | Total assets × 0.5% annual rate |

| Management fee II | Net income before tax (before deducting management fees) × net income per unit before tax (before deducting management fees) × 0.0030% (maximum rate) | |

| Acquisition fee | Acquisition price × 1.0% (maximum rate) | - |