Compliance

Basic Compliance Policy

Fully recognizing that inadequate compliance could have a disruptive effect on TLR's and the Asset Manager's management, the Asset Manager has positioned thorough compliance as one of its key management issues. Furthermore, as a company involved in the financial instruments business, the Asset Manager recognizes that it has a responsibility to strive to realize business value that meets the needs of society, and it proactively and constantly pursues compliance for the purpose of qualitatively and quantitatively increasing the value of its business.

Compliance Promotion Structure

This table can be scrolled sideways.

| Body | Main Role |

|---|---|

| Board of Directors | As the body with final responsibility for the execution of operations, the Board of Directors, with the aim of implementing thorough compliance, receives reports on matters for approval, etc., at Compliance Committee meetings, etc., and also passes resolutions on important matters relating to the Asset Manager's compliance. |

| Compliance Committee | The Compliance Committee carries out the tasks stipulated in the Compliance Committee Regulations, in collaboration with the Board of Directors, Compliance Officer, and Compliance Department. |

| Compliance Officer | As the person in charge of compliance at the Asset Manager, the Compliance Officer establishes an internal compliance structure and strives to foster awareness of internal regulations for abiding with the law and other rules. In addition, the Compliance Officer aims to improve compliance awareness and keep personnel well-informed by planning and implementing compliance training, etc. for officers and employees, etc. (this refers to all officers and employees of the Asset Manager and all other persons engaged in work for the Asset Manager; the same applies hereinafter). For this purpose, the Compliance Officer shall constantly monitor whether the execution of asset management tasks by the Asset Manager on behalf of TLR is based on the law, TLR's articles of incorporation, and other regulations, etc. and also monitor and supervise the status of compliance in the execution of daily tasks. |

| Compliance Department | The Compliance Department manages matters relating to the Asset Manager's compliance and carries out the tasks stipulated in the Division of Duties Regulations. |

Internal Compliance Structure

The Compliance Officer ensures there is a system in place that enables reports to be received immediately in the event that an officer or employee detects conduct within the Asset Manager that violates the laws relating to its business operations, or is highly likely to violate those laws, and prevents officers and employees from covering up misconduct. Furthermore, the Board of Directors supports the Compliance Officer to ensure that there is an internal compliance structure.

Handling of Conflict-of-Interest Transactions

With regard to transactions with interested parties, TLR and the Asset Manager have established transaction criteria that stipulate the regulations for such transactions and established an approach whereby transactions are conducted after performing rigorous screening based on the screening procedure specified in the regulations to ensure that transactions are not detrimental to TLR.

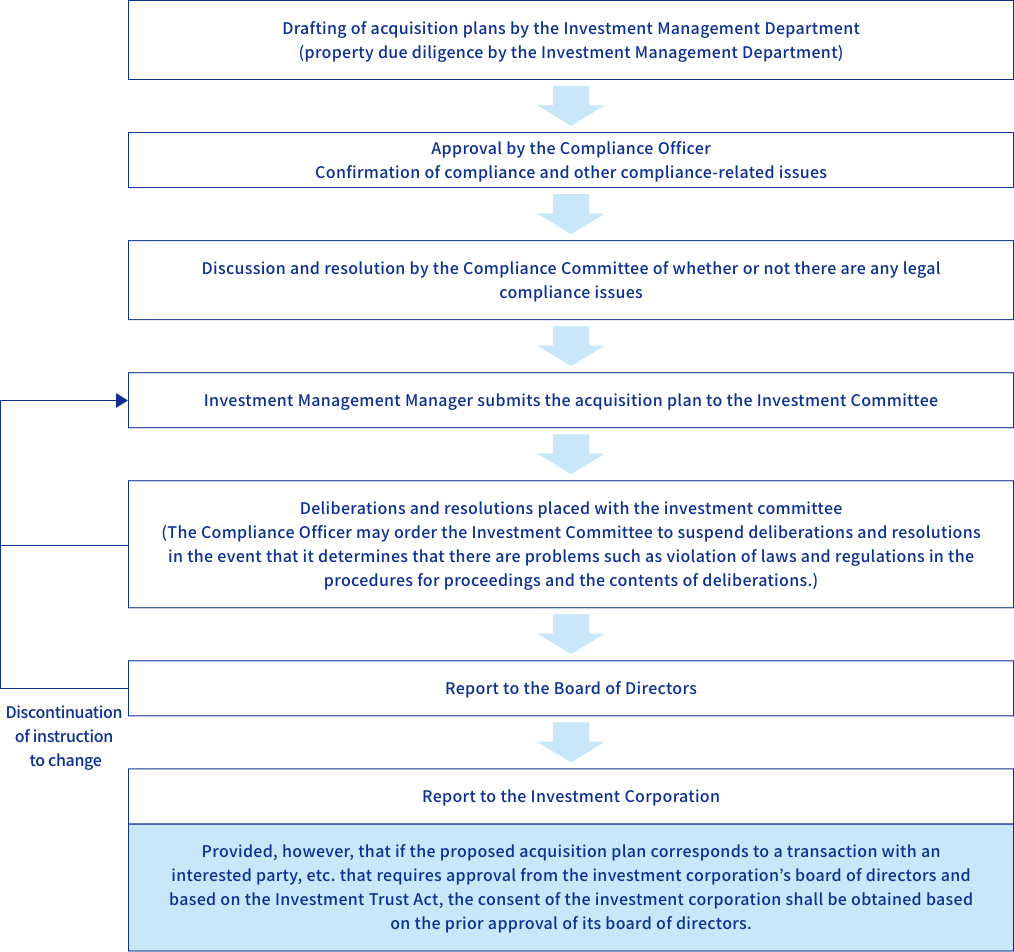

If the Asset Manager attempts to conduct a transaction with an interested party, after it is proposed by the department in charge of the transaction, the Compliance Officer will review it beforehand to determine whether it complies with the laws and regulations (this refers to laws, governmental and ministerial ordinances, by-laws, and other instructions that the Asset Manager must comply with when executing its business, Investment Trusts Association regulations, regulations of financial instruments exchanges on which TLR is listed, TLR's regulations, and the Asset Manager's articles of incorporation, internal rules, and contracts signed by it based on these, including the asset management contract for TLR, etc.) and whether there are any other compliance-related issues, and if the Compliance Officer approves the transaction, it may be brought before the Compliance Committee. The Compliance Committee will deliberate the transaction from a compliance perspective, and if it approves it, the transaction may be brought before the Investment Committee. The Investment Committee will deliberate the transaction, and upon its approval being obtained (however, in the case of transactions corresponding to transactions with interested parties, etc. in the Investment Trusts Act, as stipulated in Article 5 of the Interested Parties Transaction Regulations, the Investment Committee's approval and the consent of TLR, based on the approval of its Board of Directors, will be required), it will be decided that the transaction is to be executed.

Decision-Making Flow on Acquisition from Related Parties

Establishment of System to Eliminate Anti-Social Forces

The Asset Manager has formulated Regulations to Eliminate Anti-Social Forces and an Anti-Social Forces Elimination Manual and implements a system for eliminating relationships of any kind with anti-social forces. Specifically, under the guidance of the Compliance Officer (the officer who supervises the implementation of the system for severing ties with anti-social forces and handling of them), the Asset Manager checks for the presence of anti-social forces by investigating using a database (updated as appropriate, including the addition, deletion, and revision of information), search engine, and search records. Moreover, as a result of investigation, if it is found that the other party in a transaction (or a potential other party in a transaction; the same applies hereinafter) is an anti-social organization, if the involvement of an anti-social organization is suspected, or if an inappropriate request is received from an anti-social organization, the employee in charge shall immediately and appropriately report to and consult with the department manager (the “department manager with direct responsibility”) and the Compliance Officer. After discussing countermeasures with the Compliance Officer, the department manager with direct responsibility will seek to ensure the employee in charge's safety and resolve the matter. If it is found that the other party in a transaction is an anti-social organization after the transaction has begun, the department manager with direct responsibility will take steps to dissolve the transaction with the anti-social organization after discussing countermeasures with the Compliance Officer.

Prohibition of Political Contributions and Anti-Corruption Measures

The Asset Manager's Compliance Manual stipulates the following with regard to relationships with politicians and public officials, and the information is shared with employees when the opportunity arises (e.g., compliance training):

“With regard to relationships with politicians and public officials, we must comply with the relevant laws and regulations, such as the Political Funds Control Act (Act No. 194 of 1948) and the Public Offices Election Act (Act No. 100 of 1950), maintain sound, transparent, and honest dealings with political and governmental parties, and prevent corruption, including mutual favors, collusion, etc. Furthermore, when dealing with public officials and the like, we must not only thoroughly comply with the laws and regulations but also avoid conduct that raises doubts. Hospitality and gifts for public officials are prohibited. Providing hospitality and gifts to, or offering them, parties holding public office is subject to criminal punishment for bribery.”

Compliance and ESG Training

The Asset Manager conducts compliance- and ESG-related training for all officers and employees on a continuing basis, in which they play an active part. Compliance-related training is also provided to new hires at the time of joining the company.

This table can be scrolled sideways.

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | |

|---|---|---|---|---|---|

| Compliance Training | 2 | 6 | 6 | 4 | 6 |

| ESG Training | 2 | 3 | 3 | 1 | 15 |

Whistleblowing System

Based on the Compliance Manual and in accordance with the Whistleblower Protection Act, the Asset Manager has established a system that enables employees who become aware of a compliance-related problem or the like to report directly to the Compliance Officer or a harassment and compliance helpline without going through the person in charge of the department to which they belong (i.e., a whistleblowing system).

Click here for details.